PAY LATER EVERYWHERE

Pay Later is now a common feature in the payments landscape. This year, explore what it means to Pay Later EVERYWHERE.

This two-day summit is curated for financial institutions that are exploring Buy Now, Pay Later. Learn from industry experts and financial institution leaders about the different ways Pay Later is embedded into the everyday lives of U.S. consumers, and how to leverage it for the success of you and your account holders.

HOSTED BY

PRESS PARTNER

Sign up to Watch on Demand

[equipifi is] an embedded payment solution that's run by an incredible team that had these insights with Zelle and now they're bringing a similar frictionless financing solution to consumers. bringing a similar frictionless financing solution to consumers.

Nick Moran, General Partner at New Stack Ventures

Attended by more than 300 registrants from over 120 FIs

GOLD SPONSOR

SILVER SPONSORS

PARTNERS

AUG 20, 2025 | 1PM-2:30PM ESTDay 1: Insights

Want to grow your financial institution with the financial wellness of your account holders? #insightsinno2025 Day 1 features FI leaders sharing data, experience, and best practices for a safe, experience-elevating Pay Later program.

| 1:00 PM |

Welcome |

Jazzy Zhu, VP of Marketing, equipifi |

| 1:05 PM |

BNPL State of the Union |

Bryce Deeney, co-founder & CEO, equipifi Sean Flynn, TransUnion |

| 1:20 PM |

Understanding BNPL: The Lending Perspective Hear from lending leaders across institutions on their BNPL journey and learn how they set their strategic goals, what they expected, and what they found. |

Emelda Baca, Arizona Financial Credit Union |

| 1:45 PM |

BNPL, Debit Cards, and Deposit Relationships |

Angel Siorek, Velera |

| 2:00 PM |

Elevating the Digital Experience With BNPL Three institutions, three different BNPL launches, and three sets of lessons. Explore how different credit unions approached adoption—and how they’re winning member engagement. |

Tom Gessel, First Credit Union |

| 2:20 PM |

Closing |

Jazzy Zhu, equipifi |

| 1:00 PM |

Welcome |

| 1:05 PM |

BNPL State of the Union |

| 1:20 PM |

Understanding BNPL: The Lending Perspective Emelda Baca, Arizona Financial Credit Union |

| 1:45 PM |

BNPL, Debit Cards, and Deposit Relationships Angel Siorek, Velera |

| 2:10 PM |

Elevating the Digital Experience With BNPL Tom Gessel, First Credit Union |

| 2:20 PM |

Closing Jazzy Zhu, equipifi |

AUG 21, 2025 | 1PM-2:30PM ESTDay 2: Innovation

For product visionaries, banking tech enthusiasts, and innovation leaders, #insightsinno2025 Day Two focuses on what it takes to build, embed, and level up world class Pay Later programs.

| 1:00 PM |

Welcome |

Jazzy Zhu, equipifi Bryce Deeney, equipifi |

| 1:10 PM |

Fireside Chat: Who's on First |

Eilene Markus, ACU of Texas |

| 1:25 PM |

Q&A: BNPL & Credit Scores What have banks and credit unions been asking about BNPL and its impact on building creditworthiness? Submit your questions below and hear equipifi & TransUnions' answers. |

Laura Eufrasio, TransUnion |

| 1:40 PM |

Pay Later Lab: BNPL & Beyond How can BNPL be elevated, and even bring innovation to other financial services? Check out equipifi's collaborations exploring new enhancement and use cases. |

Gregg Hammerman, Larky |

| 2:05 PM |

Launching BNPL with API Join in to learn about how MSUFCU collaborated with equipifi to launch its BNPL program with API for greater flexibility and scalability. |

Ben Maxim, MSUFCU |

| 2:20 PM |

Closing |

Jazzy Zhu, equipifi |

| 1:00 PM |

Welcome Jazzy Zhu, equipifi Bryce Deeney, equipifi |

| 1:10 PM |

Fireside Chat: Who's on First Eilene Markus, ACU of Texas |

| 1:25 PM |

Q&A: BNPL & Credit Scores Laura Eufrasio, TransUnion |

| 1:40 PM |

Pay Later Lab: BNPL & Beyond Gregg Hammerman, Larky |

| 2:05 PM |

Launching BNPL with API Ben Maxim, MSUFCU |

| 2:20 PM |

Closing Jazzy Zhu, equipifi |

Featured Speakers

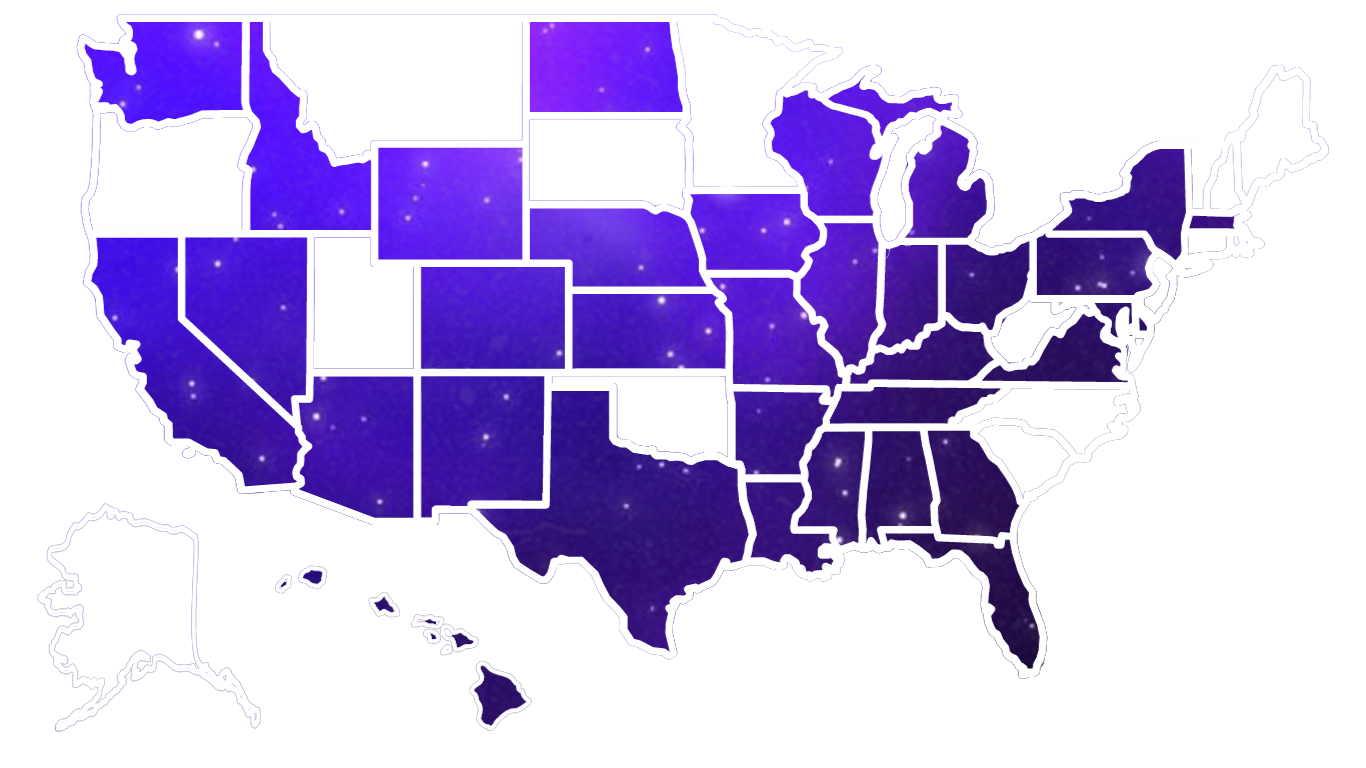

Are you on the map?

Bringing Pay Later to consumers EVERYWHERE

More than 60 financial institutions are now live with their own BNPL solutions. Will you be next?

States

FIs

Consumers

States

FIs

Consumers