The BNPL Platform for Financial Institutions

Elevate your banking experience by providing the financial flexibility consumers love.

Supercharging the banking experience for financial institutionS

IT’S TIME TO LEVEL UP Top of wallet and top of mind for every purchase

Enable split payments with your existing debit cards, accepted everywhere

Elevate your checking accounts to drive engagement with every purchase

Embed BNPL offer and acceptance seamlessly into your digital banking app

"equipifi helps us punch above our weight class.

Their BNPL solution is an innovative, easy-to-manage product that aligns with our commitment to meet the financial needs of our current and future members."

Use BNPL for easy payments

Plans per user on average each year

Million BNPL users in the US and growing

Financial Institutions in US are adding BNPL

Use BNPL for easy payments

Plans per user on average each year

Million BNPL users in the US and growing

Financial Institutions in US are adding BNPL

Check it out! It's your Buy Now, Pay Later solution

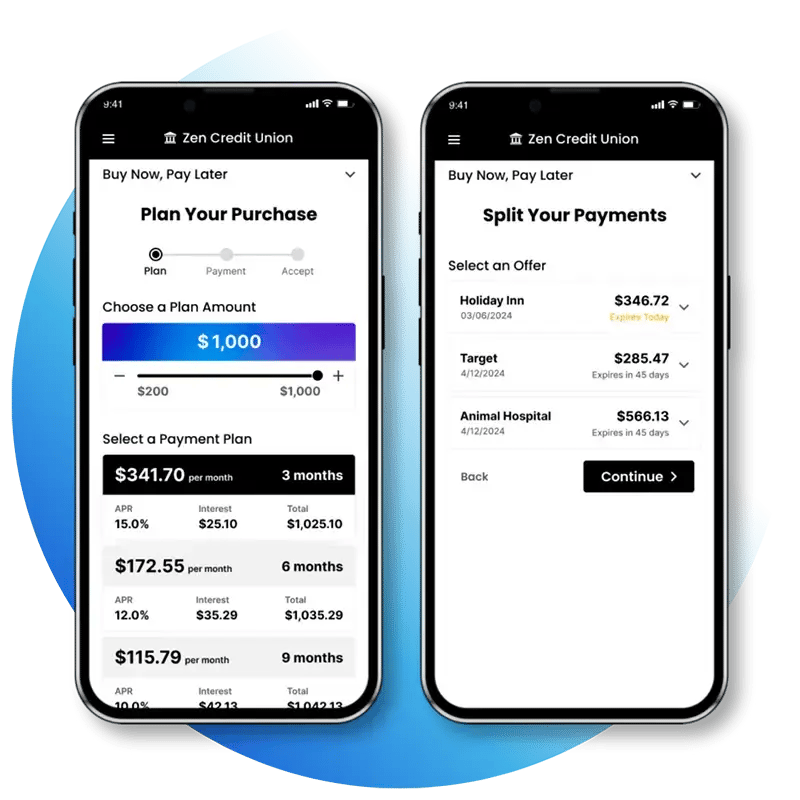

THE EXPERIENCE

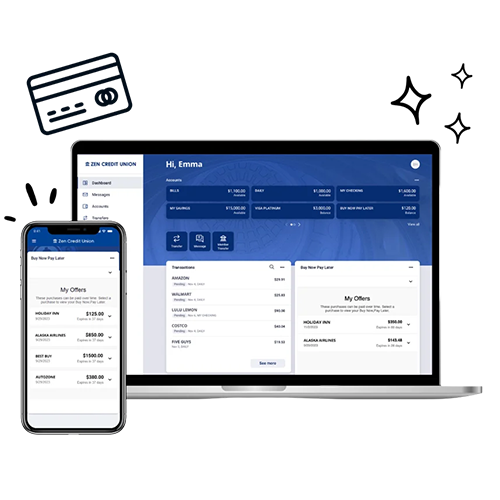

Add the power of BNPL in your digital banking.

Become the preferred provider

Provide an embedded experience your account holders can use wherever and whenever they need.

Deliver offers that empower

Give your account holders the power to choose from flexible offers that fit their unique needs.

Write loans in seconds

Generate pre-qualified BNPL offers of credit. Once accepted, deposit money back into your account holders' checking account.

THE INSIGHTS

Discover ways to drive engagement and growth

Increase account holder engagement. Give account holders a reason to engage with you every time they shop.

THE INTEGRATIONLaunch with ease with our pre-built integrations

- Your digital banking. Get your white-labeled BNPL solution within your existing app. We support most leading digital banking providers.

- Your banking core. We built the entire support for our solution with your frontline staff in mind. Our core integrations represent 1,000+ financial institutions (and growing).

- Partnering to win. From underwriting to marketing, equipifi‘s turnkey launch kit and GTM team partners with you to succeed.

From Our Customers

“We went live with equipifi and haven't looked back. Supporting members with short-term liquidity and increasing our loan growth. Thanks equipifi!”

Bryan Thomas, Chief Executive Officer

“equipifi is a great partner. BNPL is going to help our retention and make members’ lives easier. If it’s offered at a fair rate and with easy payments to make over time - then that’s what we look at as the credit union way.”

Eilene Markus, SVP of Support Services

“I’m sure that you know by now how Westmark feels about equipifi and your amazing tech. We consider ourselves to be so lucky to have found equipifi and to be able to partner with you.”

Sara Plothow, Chief Consumer Lending Experience Officer

“The equipifi team has been top notch from our first call, to implementation, and last but certainly not least, prepping us with launch communications.”

Brennan Daniels, Chief Financial Officer

“This is one of our greatest partnerships. equipifi analyzed how our members were already using 3rd-party BNPL, and helped us understand why this was a good opportunity for us to get involved and become a one-stop shop for our members.”

Jessica Hernandez, SVP of Operations

“It’s been a pleasure partnering with equipifi. They made everything turnkey so there was very little needed on our end. In our industry we usually hear about how difficult it is to launch product with vendors, but we have nothing but great things to say about equipifi.”

Carlton Brooks, Director of Lending

Why equipifi?

Drive Engagement

Make every shopping moment a banking moment

Attract New Accounts

Stay competitive by offering your account holders’ preferred payment options

Increase Interchange

Position your debit cards at the top of wallet with must have benefits

Open Revenue Streams

Unlock the profit potential of your debit card & loan portfolio