BNPL: As Told By Credit UnionS

What is it like partnering with equipifi?

Thinking about BNPL but wondering what to expect? From our first hello to your integration and beyond, launching BNPL with us is so much more than just another software purchase. From all the subject matter expertise that you'll need to a true commitment to you and your members' success, this is what our credit union partners say about working with us.

CASE STUDY

Members prefer credit union BNPL.

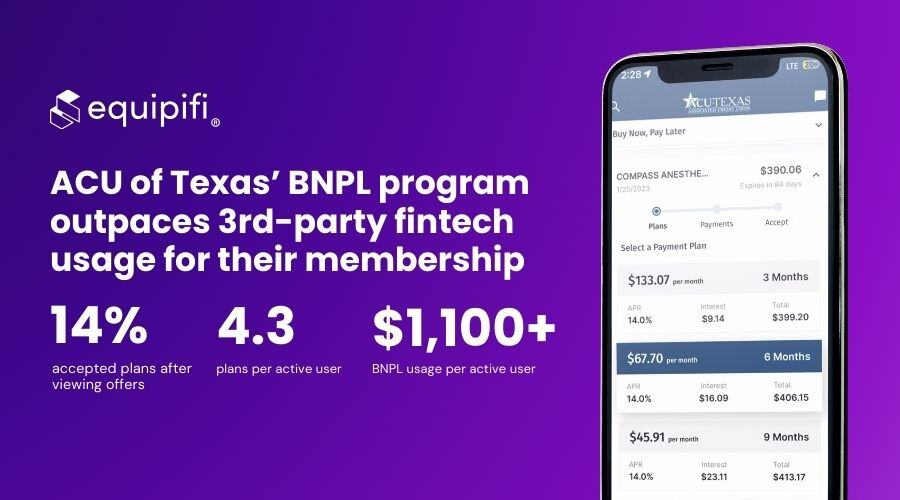

PYMNTS research found that 70% of consumers surveyed report preferring receiving BNPL from their financial institutions rather than from third-party fintech providers. ACU of Texas discovered that this was true. Within three months of launching, ACU of Texas' BNPL saw its members use its BNPL more than they used all 3rd-party BNPL providers combined.

.png)

CASE STUDY

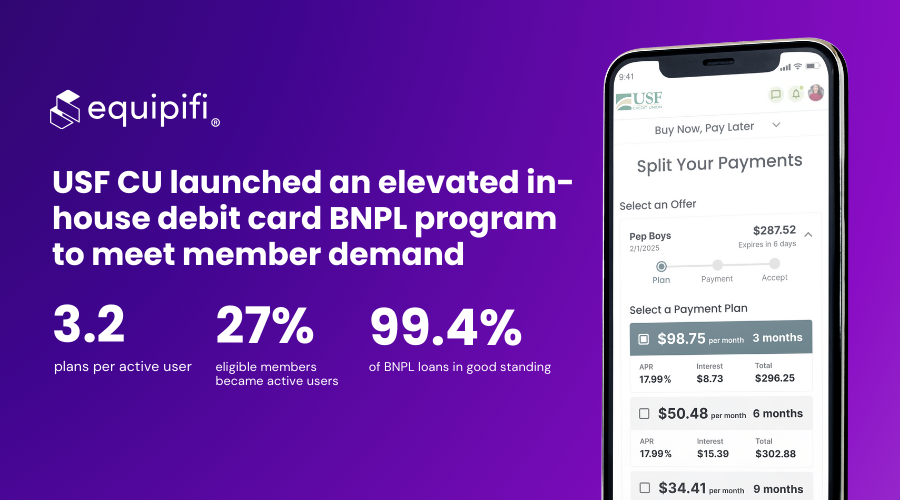

USF CU launch an elevated in-house debit card BNPL program to meet member demand

CASE STUDY

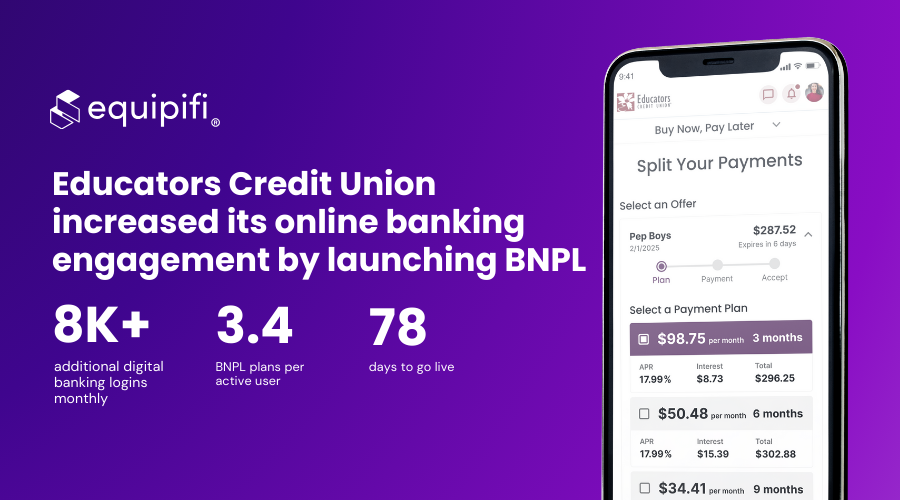

Educators Credit Union increased its online banking engagement by launching BNPL

CASE STUDY

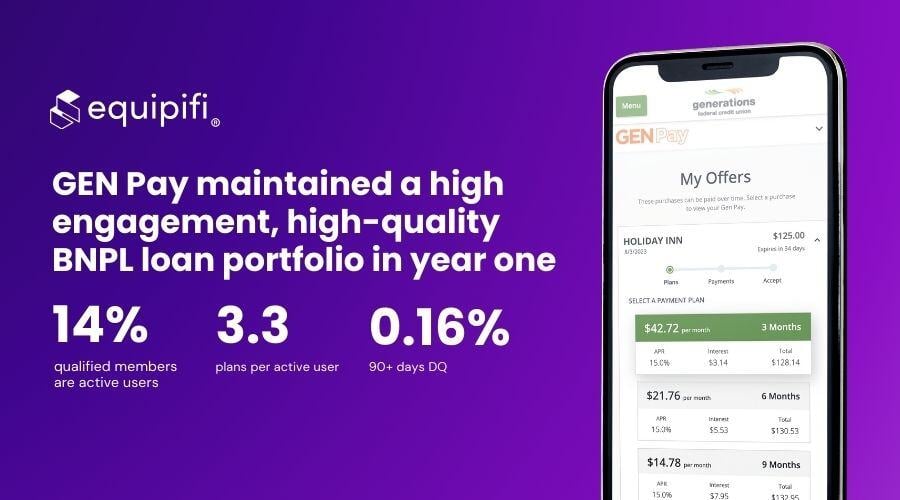

GEN Pay maintained a high engagement, high-quality BNPL loan portfolio in year one

CASE STUDY

ACU of Texas’ BNPL program outpaces 3rd-party fintech usage for their membership

Insights and Innovation 2024

[Suffolk CU] Staying Ahead of the Curve Through Innovation

What does it take to be first? How do you provide a new product that members prefer while ensuring a high quality loan portfolio? Join Indira Khan, SVP of Consumer & Mortgage Lending at Suffolk Credit Union on her #InsightsInno2024 session on being Ahead of the Curve Through Innovation with BNPL.

[USF FCU] Meeting Account Holders Where They Are

Whether it is to help members stretch their budget for everyday purchases, or to be available with extra funds during an emergency, BNPL helps credit unions serve members in a timely and holistic way. Join Jamie Walls, Sr. Dir. of Consumer & Commercial Lending at USF FCU on his #InsightsInno2024 session.

Innovation, Community, and Growth with BNPL

Why do credit unions invest in Buy Now, Pay Later? Join Eric Givens (Arizona Financial), Tansley Stearns (Community Financial CU), and Jessica Hernandez (Generations FCU) as they share how their financial institutions have strategically leveraged BNPL to innovate, serve their community, and grow.

Want to learn more? Let's chat!

We're happy to answer your questions, connect you with our panelists, and show you how BNPL can look like for your credit union.

.png?width=800&height=450&name=Suffolk%20CU%20InsightsInno2024%20(4).png)

.png?width=800&height=449&name=Suffolk%20CU%20InsightsInno2024%20(3).png)