It comes as no surprise that Buy Now, Pay Later (BNPL) and its growth as a preferred payment option have been largely driven by Millennials and Gen Z users. While we have also seen significant usage across the board with Gen X and Boomers, it is these “next gen” users that are the reason why fintechs, large technology companies, and financial institutions alike are paying closer attention to this growing trend. This article does a deep dive into why BNPL is so attractive for these next gen users, why their interest matters, and what financial institutions can be doing with these findings.

How many Millennials and Gen Z users are using BNPL?

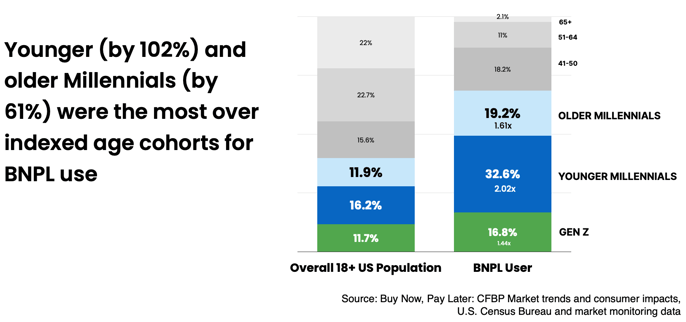

In the recent report titled Buy Now, Pay Later: Market trends and consumer impacts, the Consumer Financial Protection Bureau (CFPB) reported that in 2021, younger Millennials (ages 25-33) overwhelmingly lead as the largest segment (32.6 percent) of BNPL users, overindexing their share of the US population by 102 percent. Older Millennials and Gen Z BNPL users follow close behind. In aggregate, next gen consumers comprise 39.8 percent of the US population and 68.6 percent of all BNPL users.

This number has since increased. Insider Intelligence reports that in the US, “55.1 percent of Gen Z digital buyers ages 14 and older will use a buy now, pay later (BNPL) service at least once this year”. Shopping seasons such as the holidays are also key moments in which BNPL usage grows. A survey by Retail Dive found that “almost half (48 percent) of Gen Z respondents said they planned to use BNPL services this holiday season, followed by millennials (47 percent), Gen X (40 percent) and baby boomers (14 percent)”.

In other words, 2022 has been a year in which BNPL has continued to grow, and next gen consumers are still the major driving demographic, with little signs of it stopping going into 2023. And why does this matter? Because Insider Intelligence has predicted that in 2023, “the average US user will spend more than $1,000 with BNPL services, with total payment value nearing $95 billion”. Nearly 70 percent of them will be next gen consumers.

Why are Millennials and Gen Z using BNPL?

From macroeconomics to user experience to financial circumstances, there are a myriad of reasons why Millennials and Gen Z have chosen to add BNPL into their financial tool kit when they budget and shop. We have also interviewed several next gen BNPL power users to provide additional perspective to these third party findings. Here they are:

- It’s easy and convenient. While this isn’t just a next gen preference (A recent PYMNTS survey found that “across generations, nearly 60 percent of consumers say they prefer [BNPL] over credit cards”), much of the popularity of BNPL’s success with the mobile-based, eCommerce-obsessed, digitally-savvy younger generation comes from how simple it is to use. In fact, the approval process is so quick and simple that it has caused the CFPB to express concern over how easily overextension and loan stacking can take place. Current third-party providers do not have access to the consumer data necessary to guarantee consumer financial health in the process of BNPL offer extension. Nevertheless, every next gen BNPL user we interviewed confirmed that convenience was the key reason why they used BNPL, and a factor they took into consideration when choosing one third-party provider over another.

- Many next gen consumers are credit adverse. Believe it or not, many Gen Z and Millennial consumers have a wary attitude when it comes to credit cards. Citizens Pay noted that this is because “many watched their parents struggle with credit card debt amid the 2008 economic recession”. Indeed, all of the next gen BNPL users we interviewed expressed an aversion to “spending money that I don’t have”, and even adjusted their BNPL usage according to their cash flow. One of the interviewees explicitly stated, “I don't like things that can mess up my credit score”.

- Transparency and cash flow visibility. Citizens Pay noted that Gen Z and Millennials wanted to know “how long it will take to pay off a big-ticket purchase” and to “understand the time frame of payments”. The clarity with which third-party BNPL providers spell out the terms for users is a welcomed reassurance. Our interviewees all stated that they wanted to have control over their savings and know where their money is going at all times. In fact, one next gen user noted that she preferred to be notified by email whenever money is going into and leaving her account so she can keep an eye on it. But how are they tracking it today? Manually.

- They are low on cash (and many haven’t built up credit yet.) Many Americans are feeling the impact of the rising costs of living this year, and a Bankrate survey found that “younger shoppers are likely to experience the most financial stress this year”, with “nearly one in four millennial and Gen Z consumers said they expected to feel pressure to spend more during the holidays than they're comfortable with”. 32 percent of young shoppers were expecting to go into debt this holiday season.

Why should financial institutions care about next gen BNPL usage?

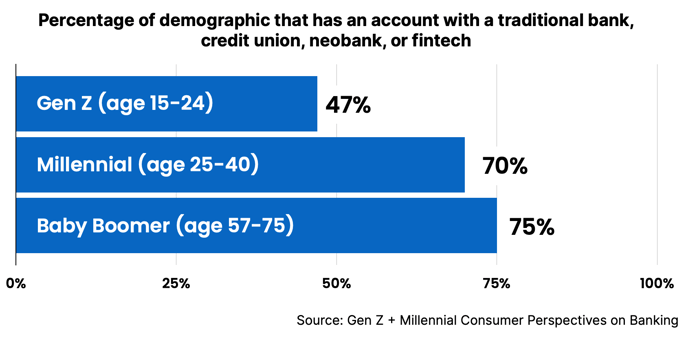

From the usability of the solution to addressing financial strain, next gen BNPL users are flocking to third-party providers to address the current gap they are experiencing in their payment capabilities and necessary expenses. A recent survey conducted by MX showed that “less than half of Gen Z [ages 15-24] admit to having an account with a traditional bank, credit union, neobank or fintech”. Although seven out of ten Millennials answered affirmatively in the same survey, there is an entire generation that is being underserved by financial entities.

What’s more, in addition to the credit aversion of next gen users, the CFPB found that 89 percent of loan repayments for BNPL were being made on a debit card, showing that even more of the next gen consumer’s financial relationship was shifting away from where they bank. How does this correlate with PYMNTS’ findings that "54 percent of Gen Z consumers, 57 percent of bridge millennials and 60 percent of millennials said they would be interested in [BNPL] from their banks”? It means that today, many financial institutions are losing engagement, revenue, and even cardholders themselves due to changing preference toward BNPL. But not because next gen consumers are averse to financial institutions, but because BNPL solutions that they’re looking for cannot be found there.

So what can banks and credit unions do?

So what can banks and credit unions do?

Despite these macro level trends, every financial institution is different and so are the preferences of their next gen cardholders. The first thing financial institutions can do is to assess how much impact BNPL transactions are having on their business, and to what extent this is coming from next gen users. Use your advantage as a financial institution to understand what this is saying about the financial health of your next gen cardholders and how successfully you are serving their needs. Pay attention to shopping seasons. Do higher usage correlate with events that signal financial stress? If so, how can you help relieve financial stress in the short term? Is there any need for long term solutions?

It’s never too early to start getting ahead.

SHARE