An open ecosystem for a supercharged Buy Now, Pay Later solution

equipifi partners with a network of core providers, digital banking platforms, fintechs, and consulting services to power the most advanced BNPL solutions for account holders.

This could be the beginning of a beautiful friendship.

Core IntegrationBank BNPL with real time data and transactions

Enable client financial institutions to write BNPL plans directly to the core

Integrate the equipifi decision engine for automated BNPL underwriting

Automate BNPL account creation and real time limit management

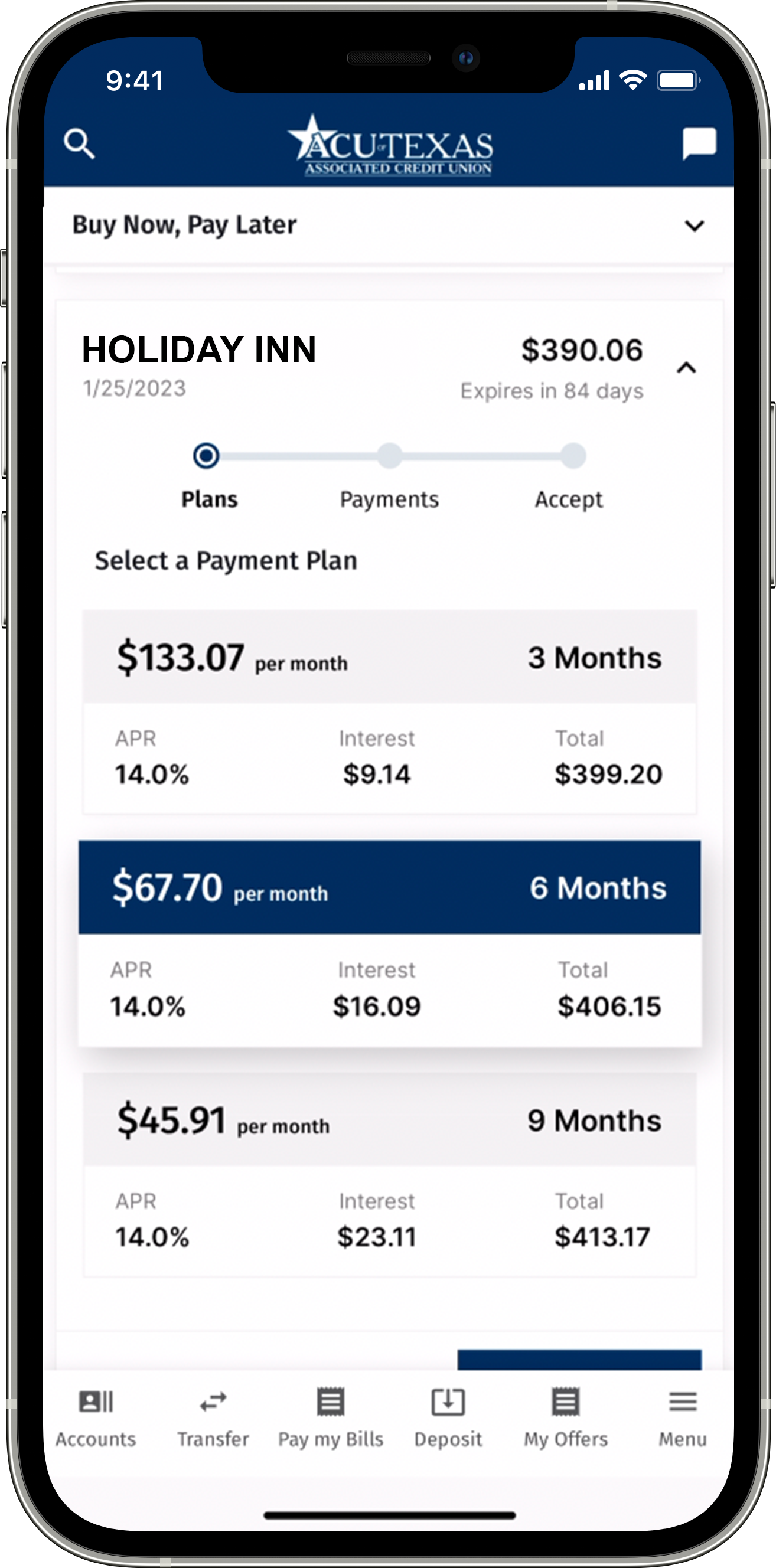

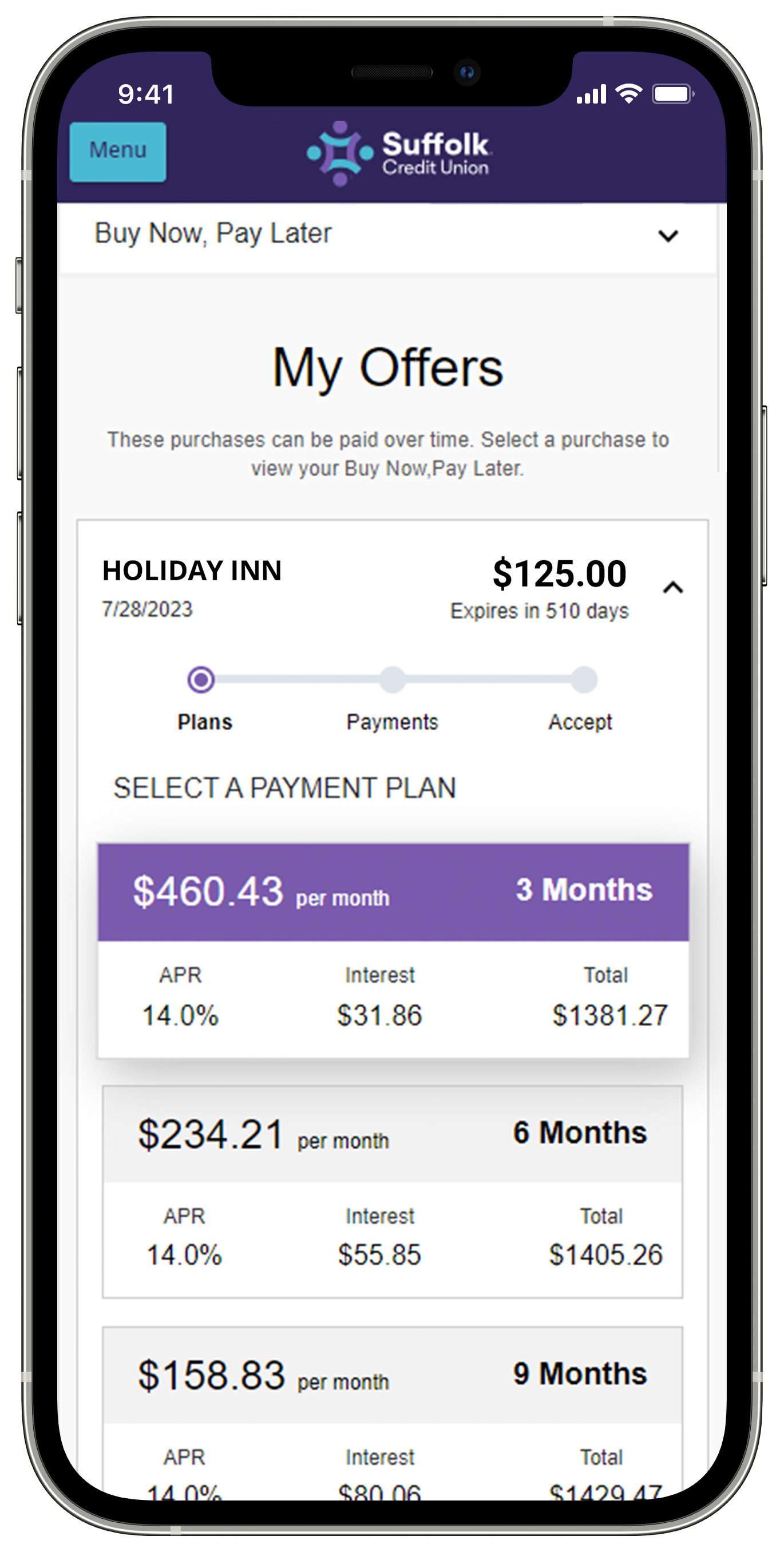

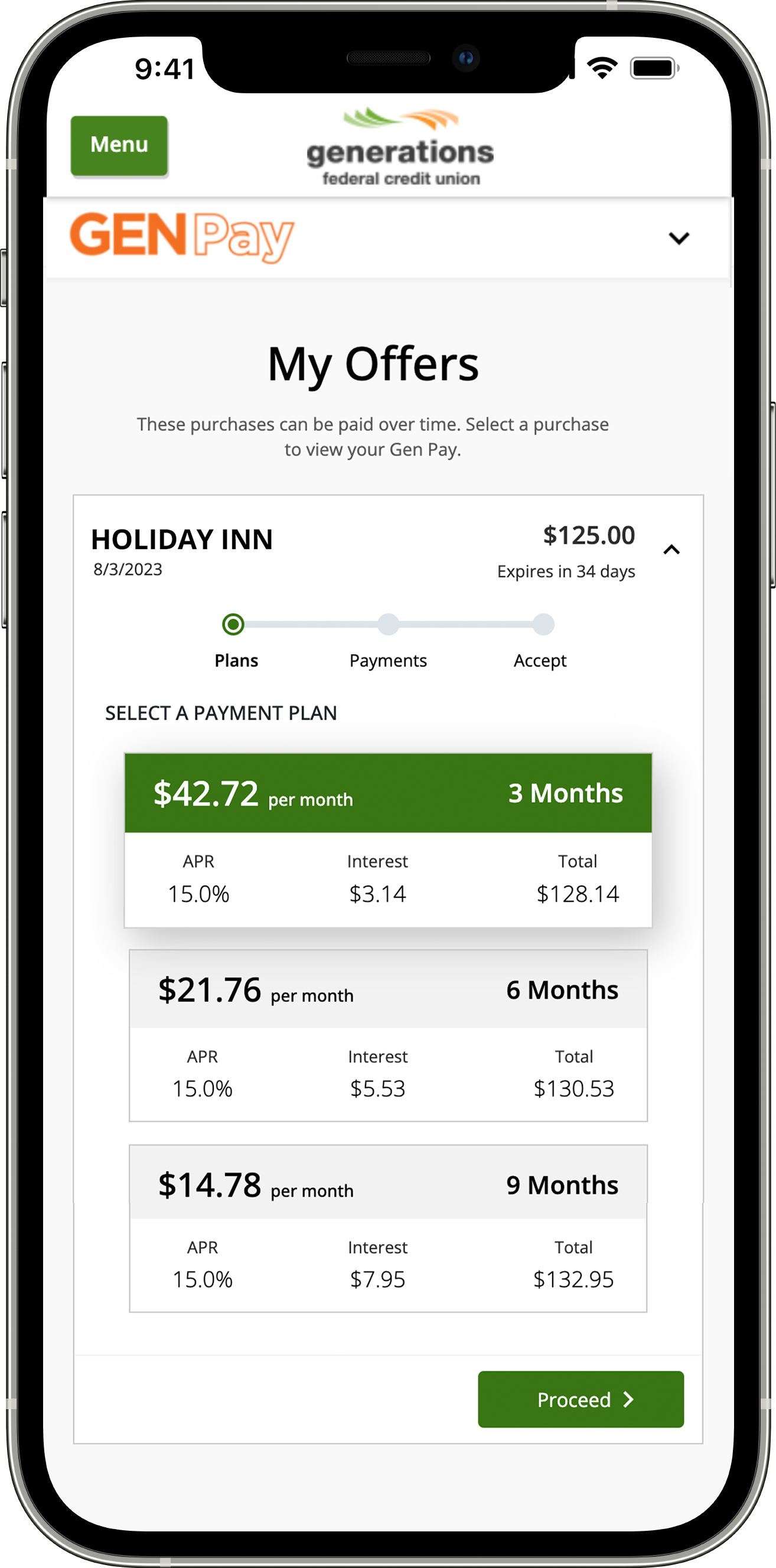

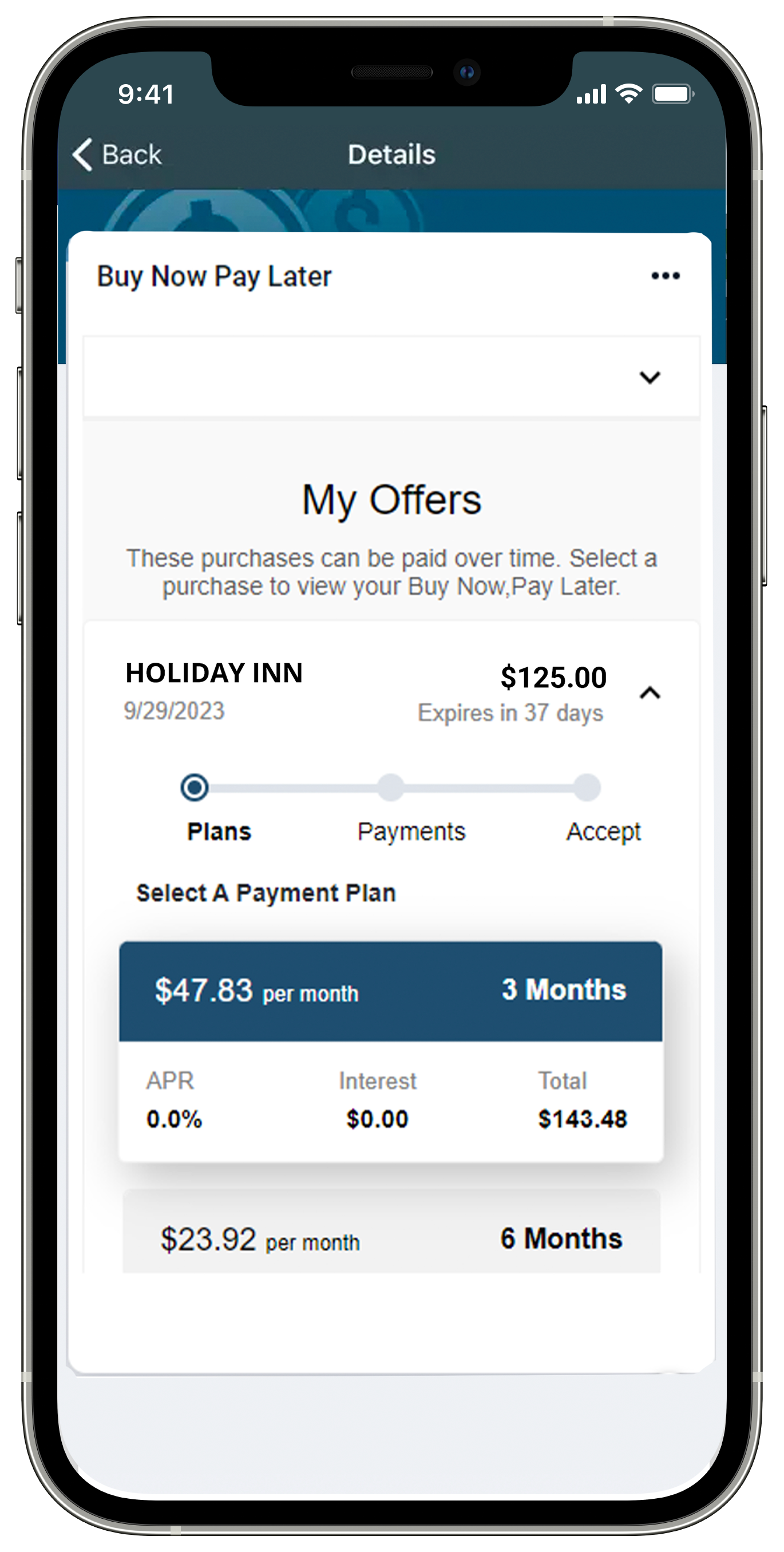

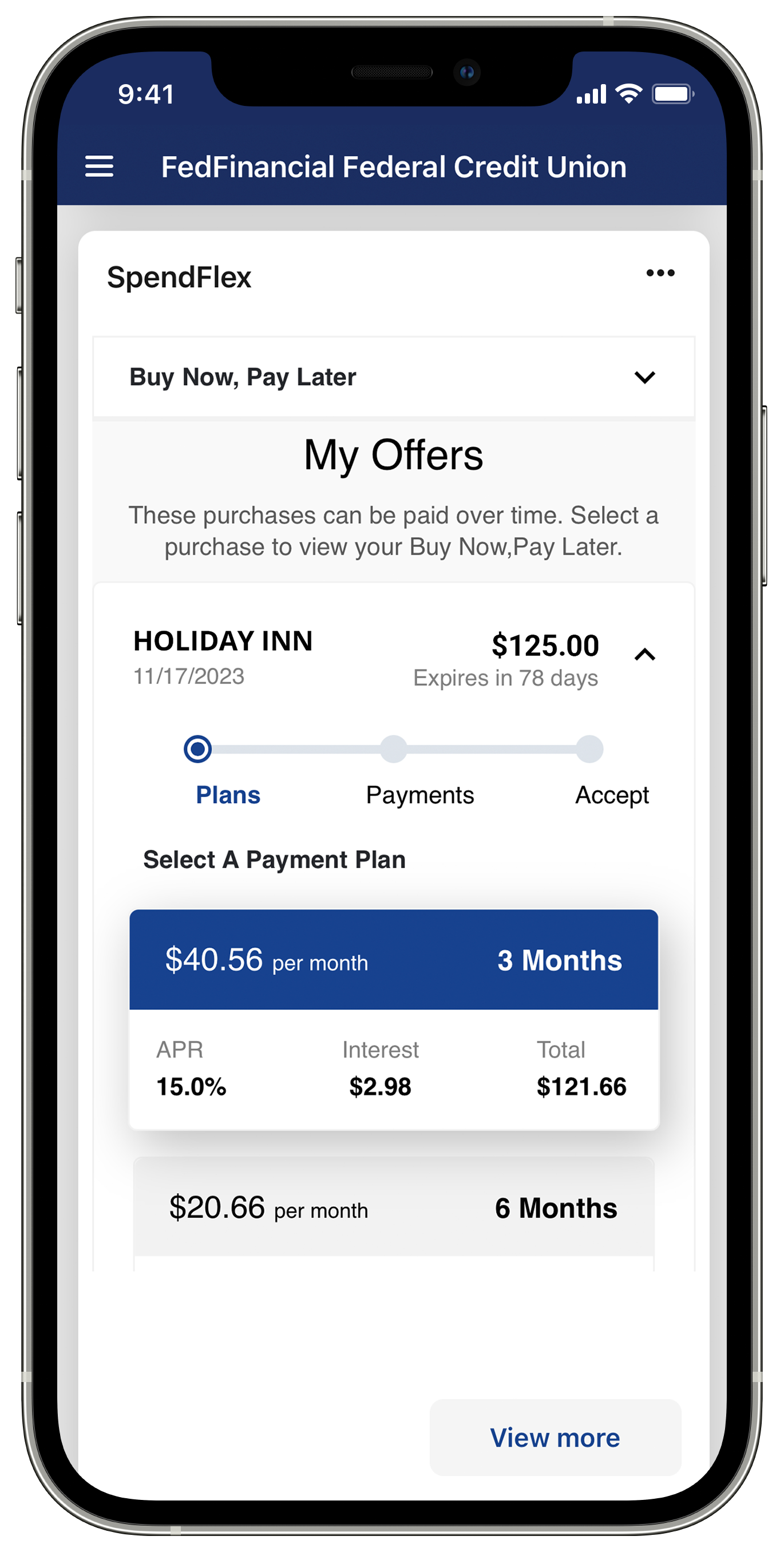

Digital IntegrationFully embed BNPL into the digital banking experience

- Enable account holders to receive and accept offers, and manage their BNPL plans

- Automate notifications based on account holders transactions

- Increase consumer engagement with their trusted financial institution

Consulting ServicesBring BNPL insights and innovation to financial institutions

- Engage client financial institutions with the most in demand payment preference

- Partner to educate client financial institutions with cobranded webinars, case studies, and more

- Drive client value by introducing the latest insights and product features from BNPL subject matter experts

This could be the beginning of a beautiful friendship...

Do you think BNPL by financial institutions is in store for your customers? We do too.

Connect with us to see what our partnership can unlock together.