Plan Your Purchase with BNPL

Giving your account holders access to the funds they need before they go shopping.

No credit check. No application. Pre-Purchase Buy Now, Pay Later

It's purchase financing on-the-go

Grow loan volume & activity

Generate pre-qualified BNPL offers at scale with no manual intervention from the financial institution

Attract new accounts

Drive engagement and grow accounts by launching flexible financing, with funds deposited in moments

Drive interest income

Grow revenue by providing personalized installment loans to account holders when they need funds

Increase engagement

Turn every purchasing occasion into a positive budgeting experience, centered around your digital banking app

Removing all obstacles.The funds they need, now

With Plan Your Purchase, remove all friction and obstacles between your account holders and the funds they are already qualified for. That means:

No credit check. No application. No cost to access. No existing transaction needed. No dependency on merchant integration. No waiting for approval and depositing funds.

Expanding accessibility.Double the engagement

Studies show that BNPL availability helps consumers decide what they will buy, and when. Plan Your Purchase empowers you to answer that question for your account holders.

All Plan Your Purchase offers are generated based on an individual's unique account standing, and they can find their eligible BNPL offers in your digital banking experience.

So why limit purchase financing to only transactions that have already occurred? Expand the reach of your BNPL today!

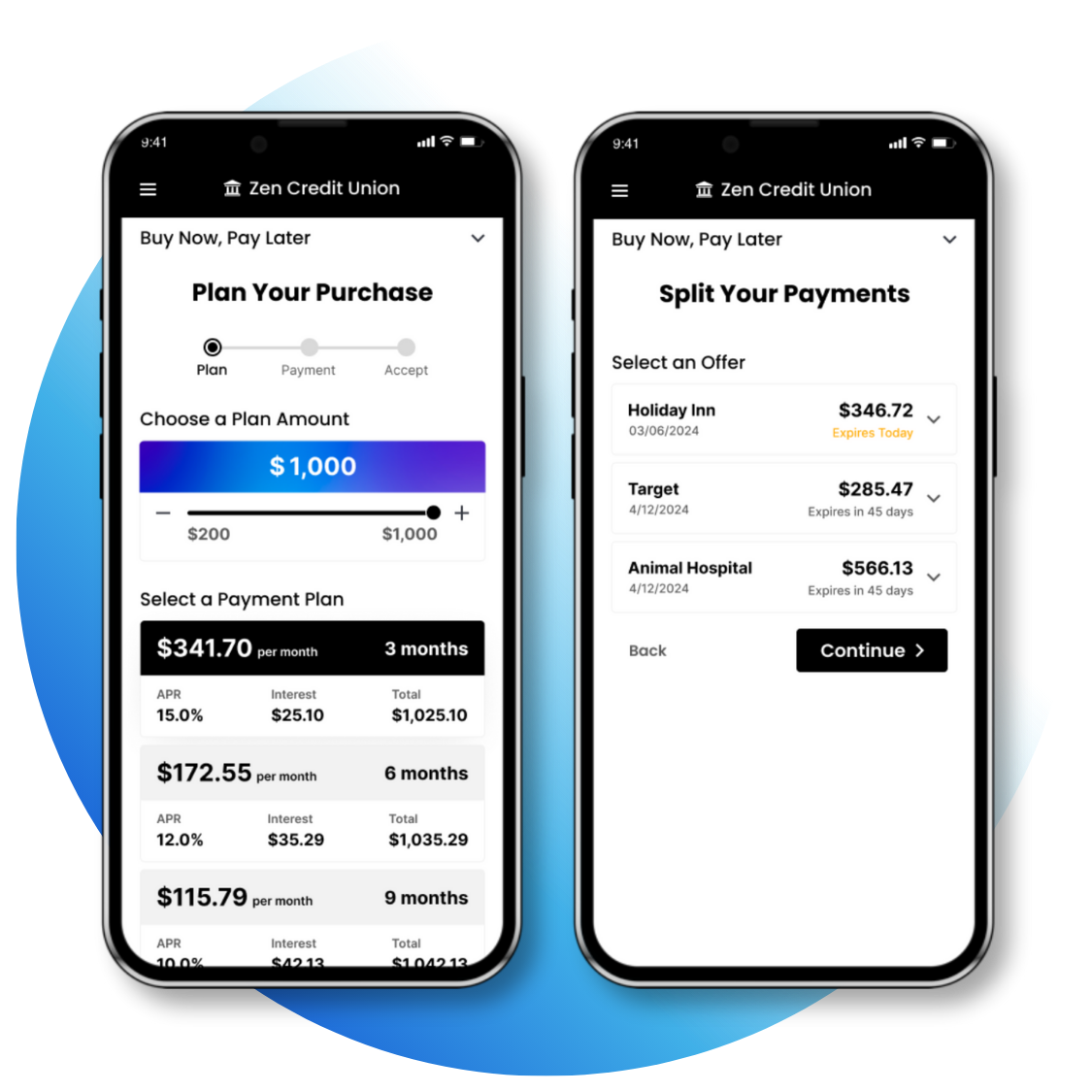

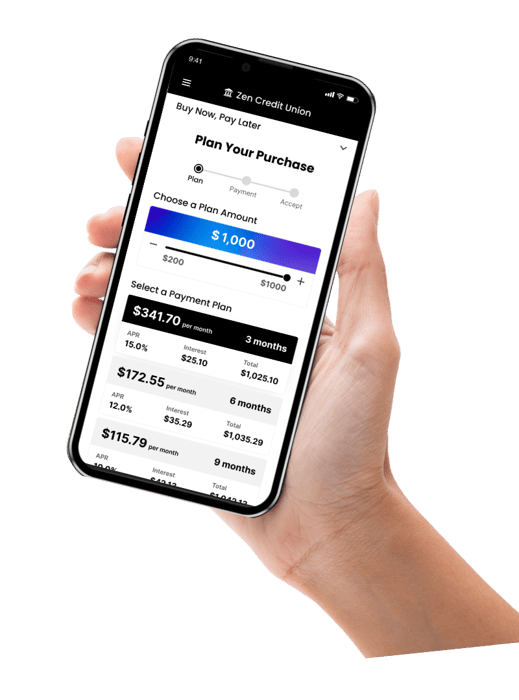

Their funds are clicks away. How does Plan Your Purchase work?

-

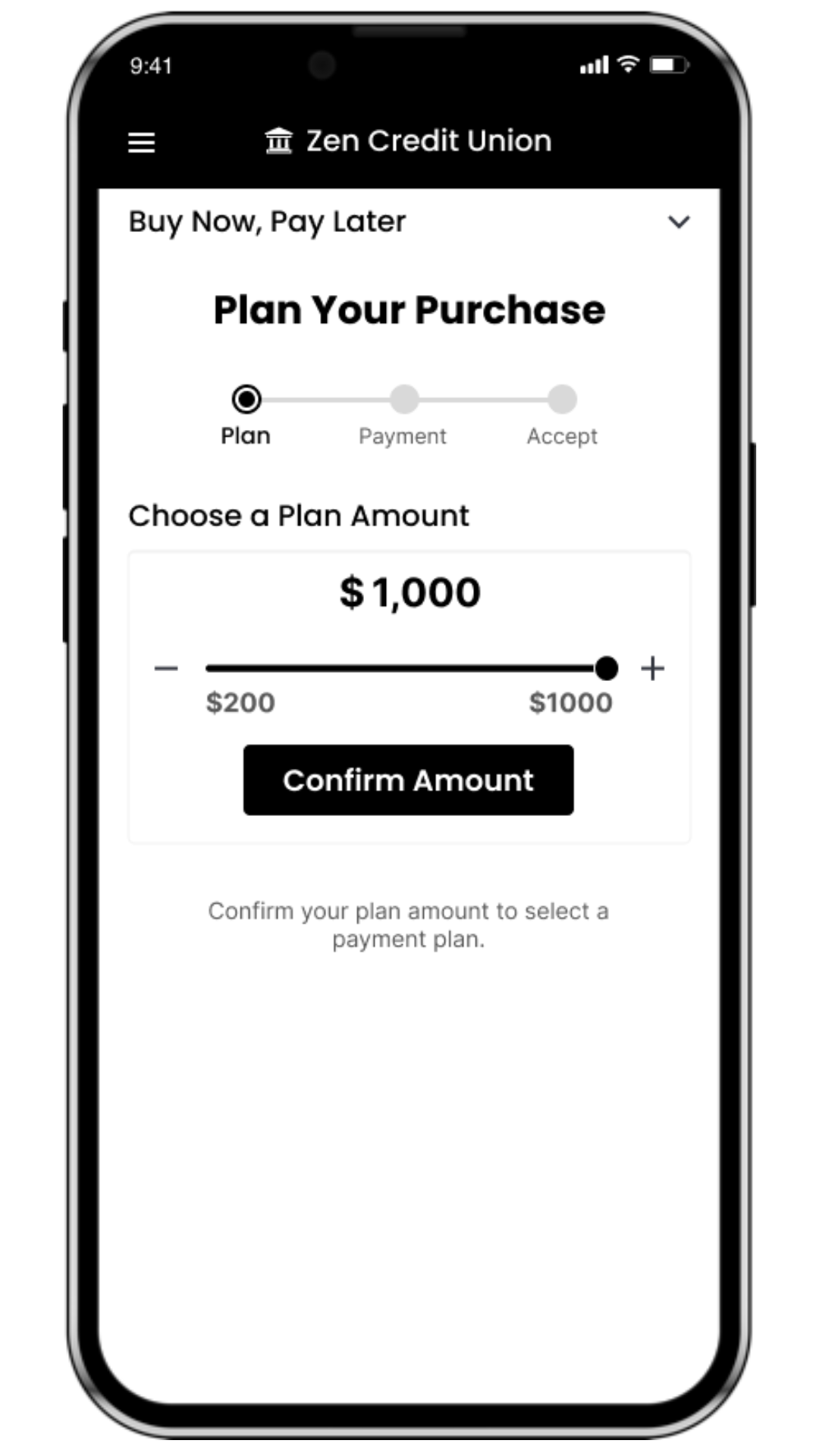

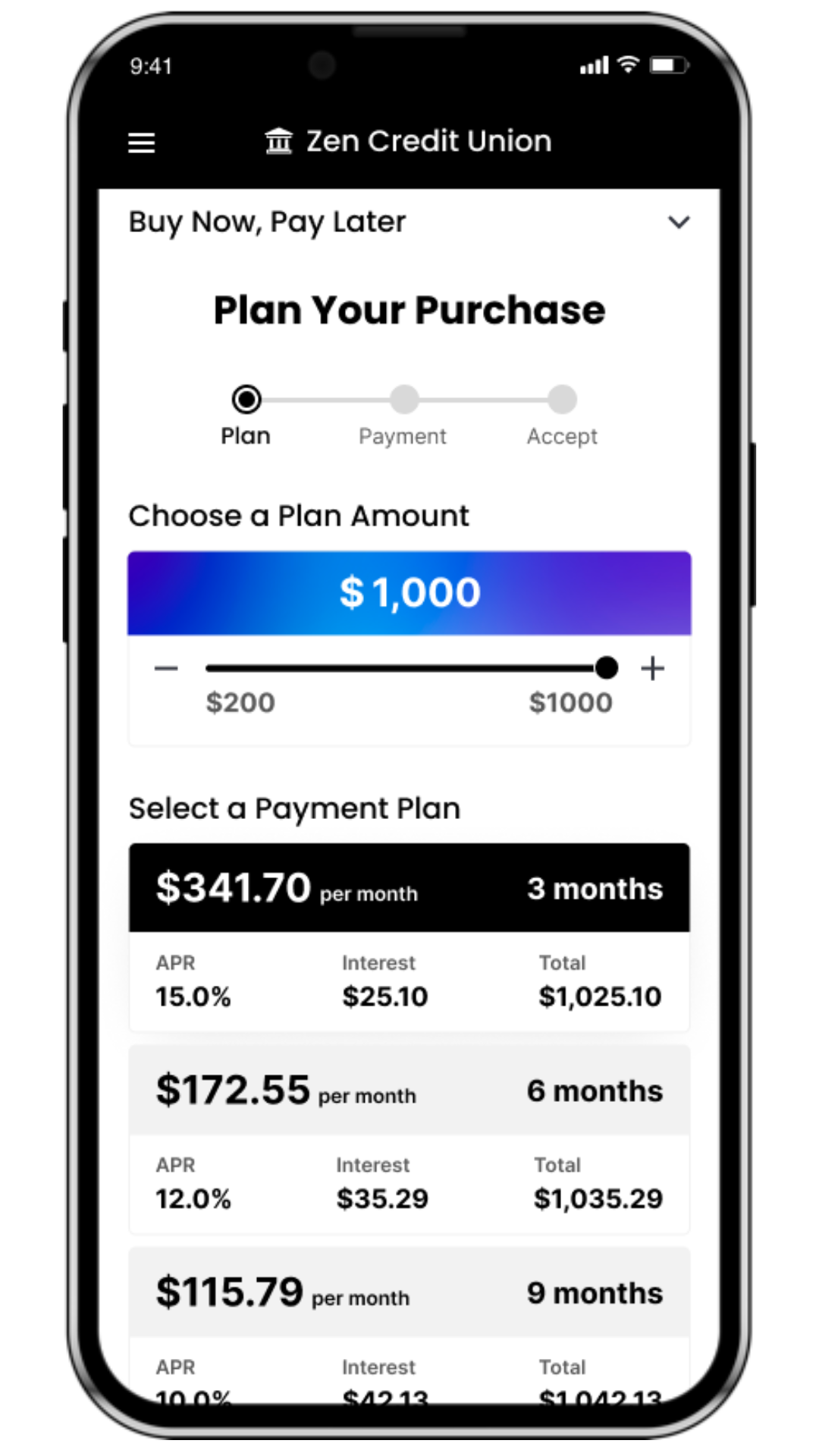

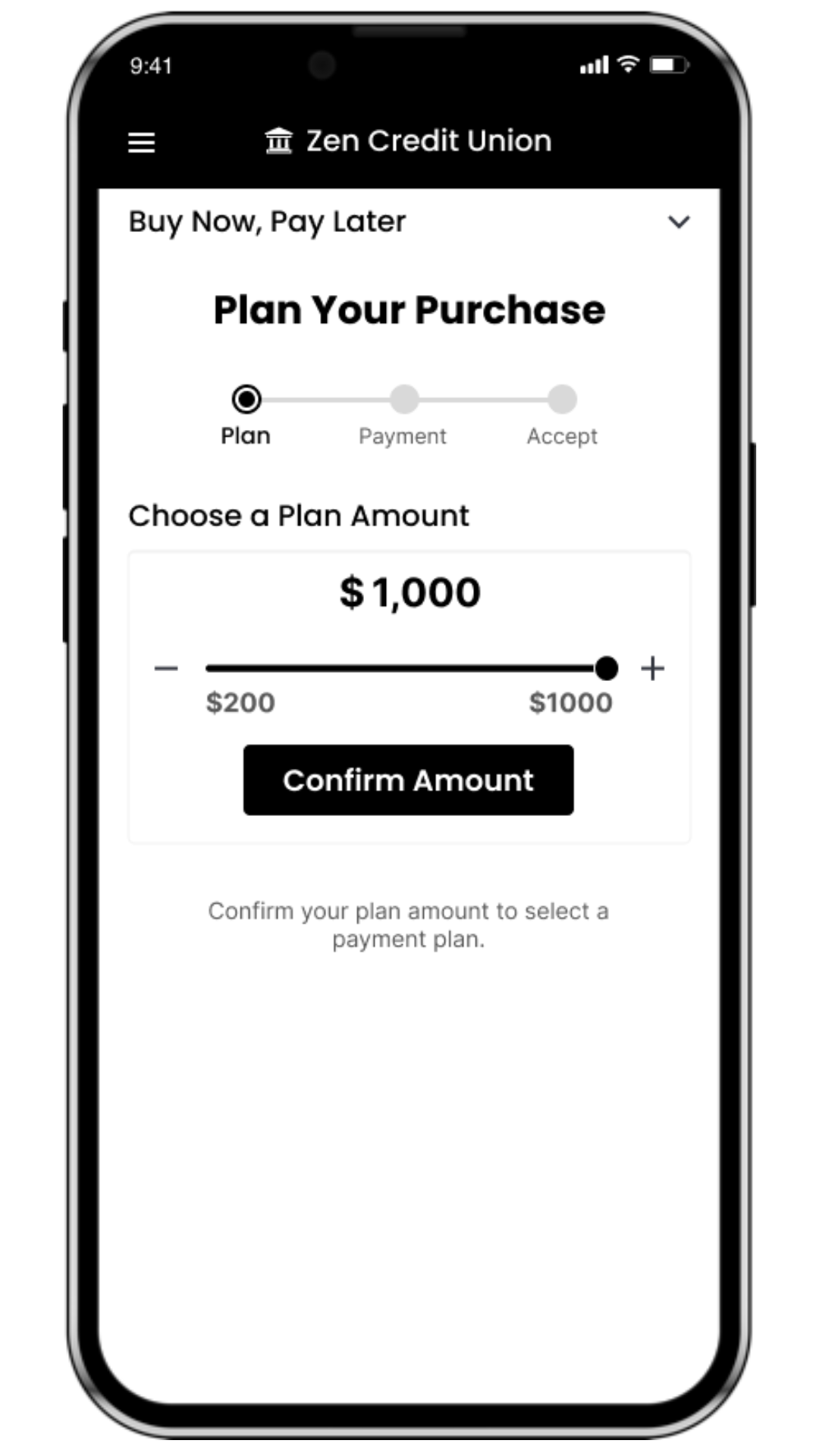

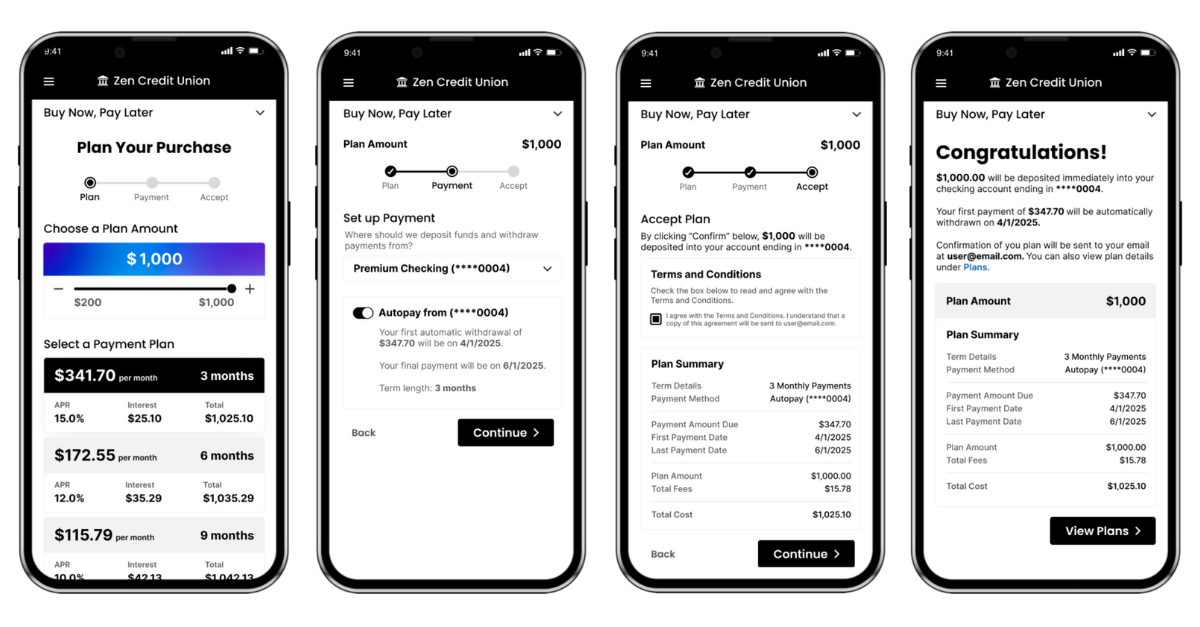

Pick an amount

Set your Plan Your Purchase parameters and let your account holders decide the amount they need

-

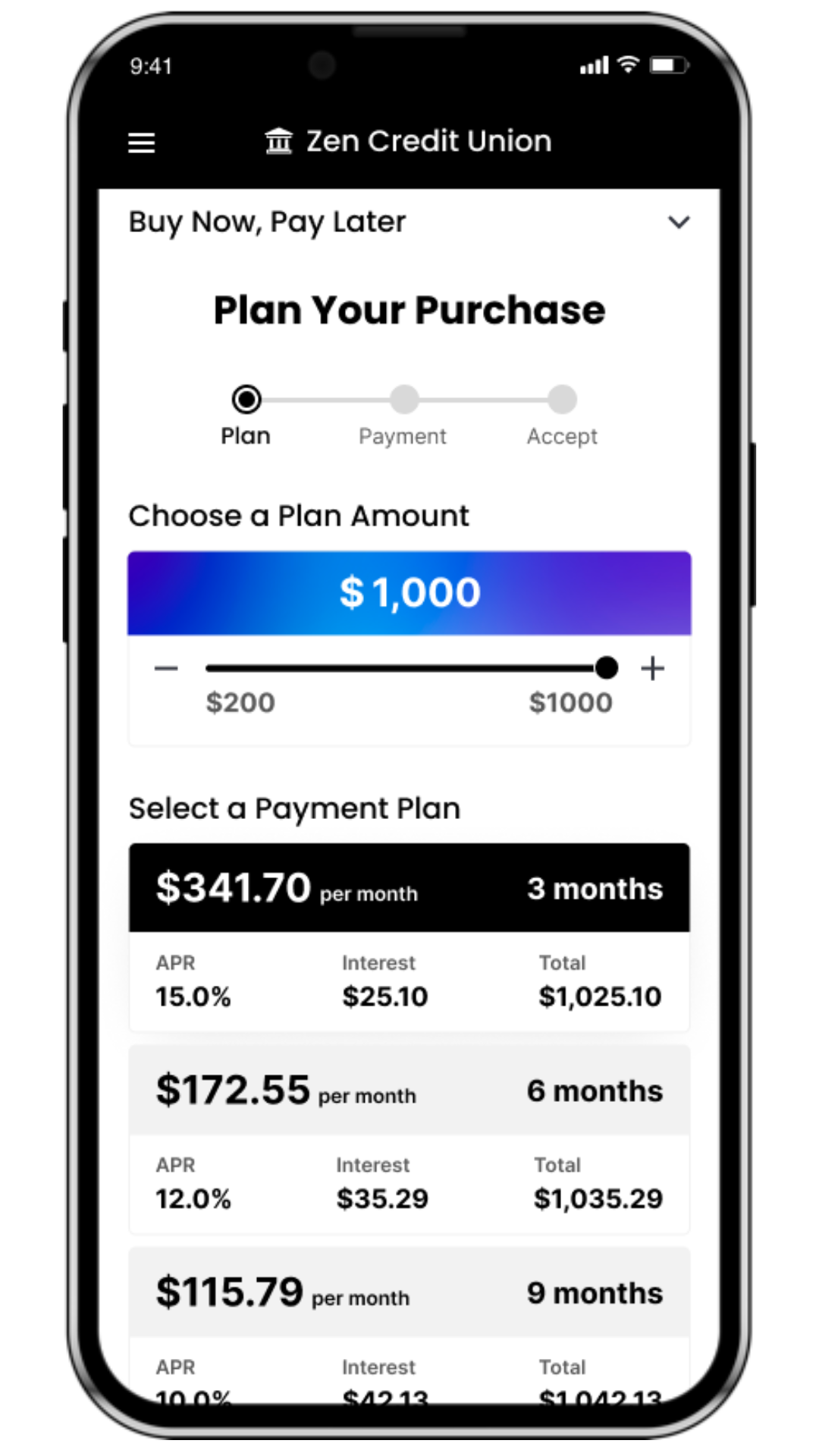

Choose repayment term

Account holders select their repayment term based on your Plan Your Purchase parameters

-

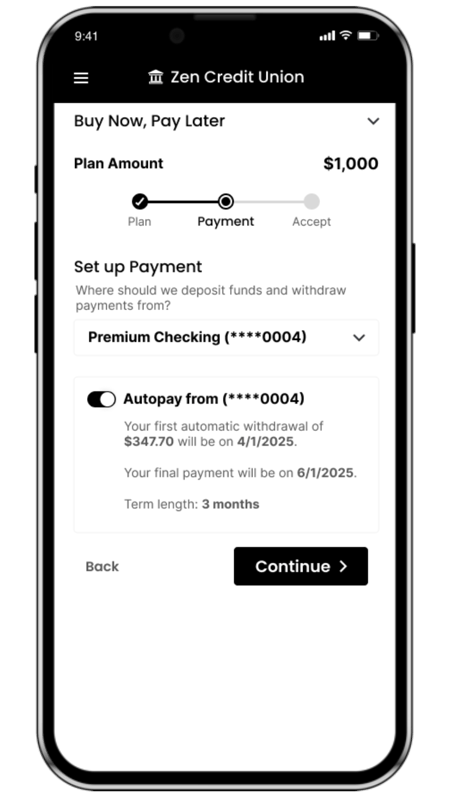

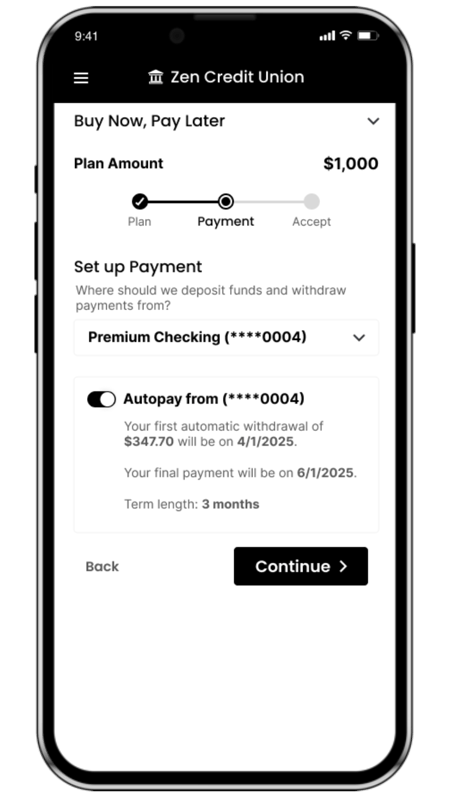

Select checking account

Account holders select the checking account where their loan proceeds are deposited

-

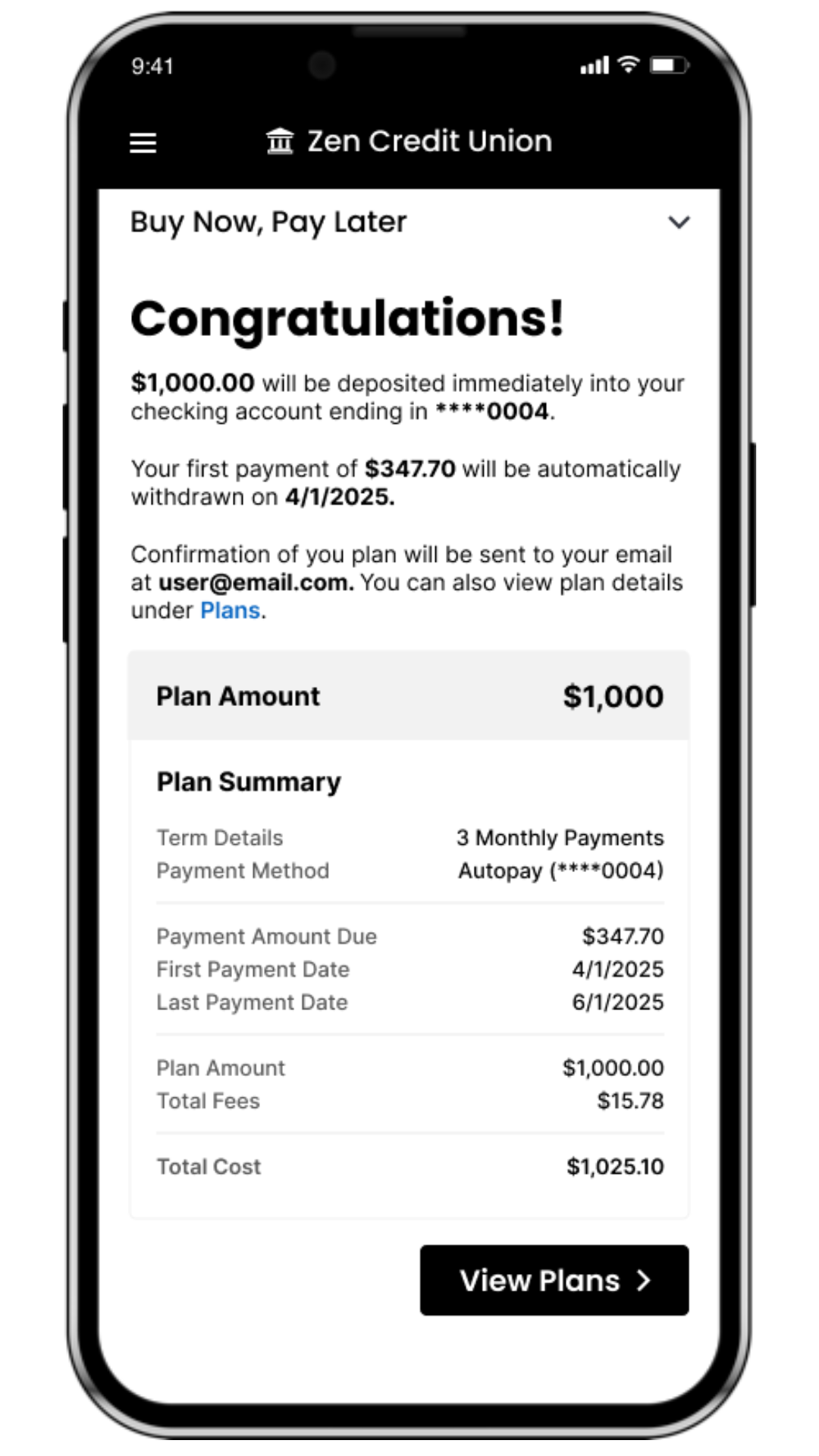

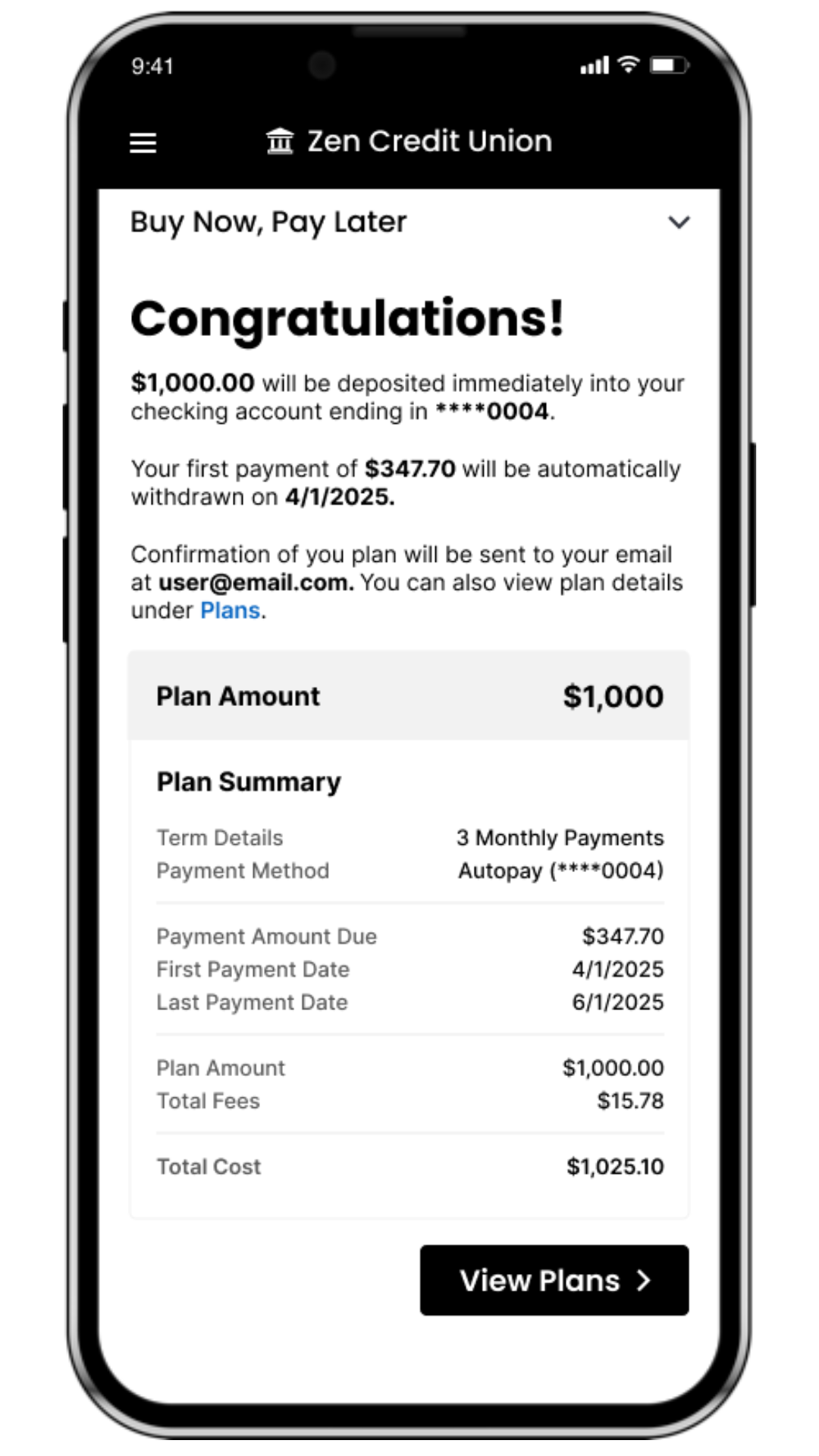

Accept & fund the loan

From offer review to loan creation and funds deposited, Plan Your Purchase loans are completed in just a few clicks and account holders receive their funds in moments

Their funds are clicks away. How does Plan Your Purchase work?

Pick an amount

Set your Plan Your Purchase parameters and let your account holders decide the amount they need

Choose repayment term

Account holders select their repayment term based on your Plan Your Purchase parameters

Select checking account

Account holders select the checking account where their loan proceeds are deposited

Accept & fund the loan

From offer review to loan creation and funds deposited, Plan Your Purchase loans are completed in just a few clicks and account holders receive their funds in moments

SOME OF OUR CLIENTS

Pre-Purchase & Post Purchase One platform to rule them all

So you want Plan Your Purchase?

If you're connected to equipifi's BNPL platform, you've already got it! Plan Your Purchase is available via the same banking core and digital banking platforms used to enable all equipifi-powered BNPL. No new integrations. The same BNPL platform — expanded.

Reach out to your equipifi representative about turning on Plan Your Purchase, or schedule a demo with us.