THE EXPERIENCESupercharging your banking experience with BNPL

Launch split payments on your online banking with the power of a fintech

Consumer expectations for banking is changing, and it’s being driven by BNPL.

.png)

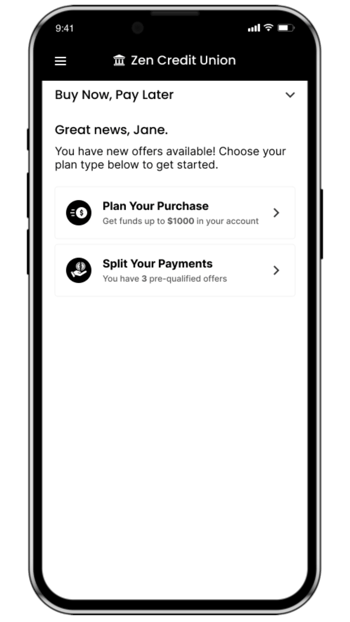

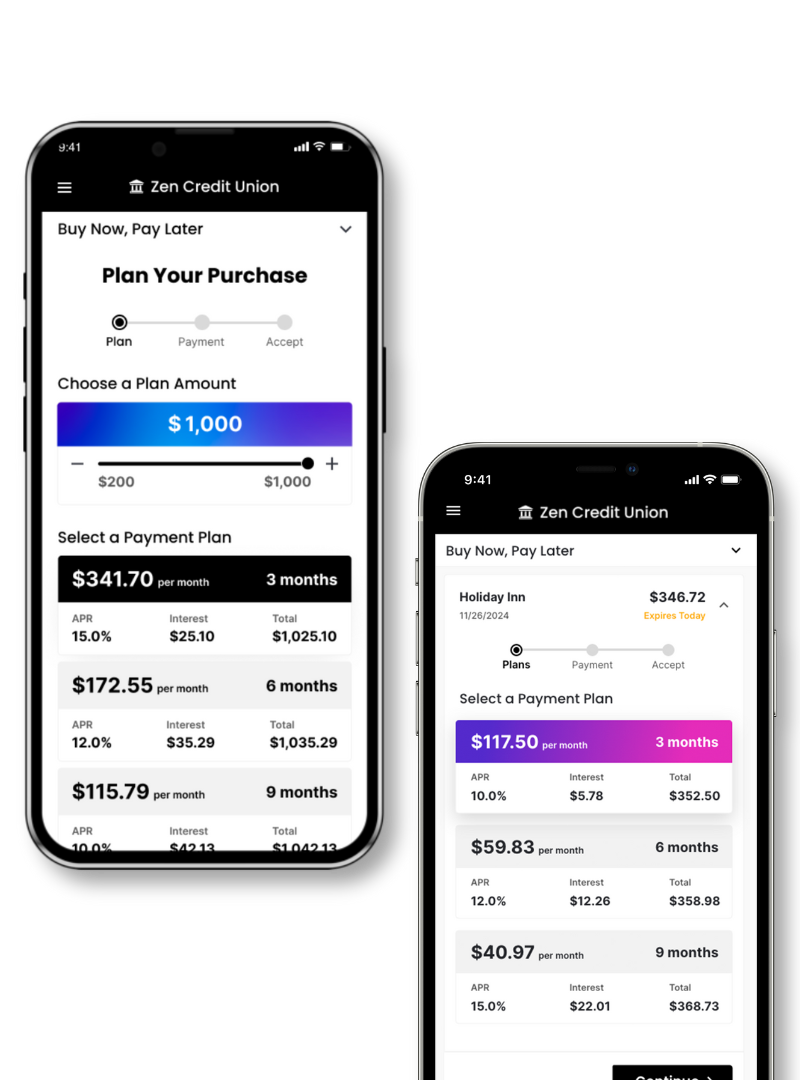

Purchase financing on-the-go

Account holder needs extra funds for a purchase

Your account holder needs extra funds now to make a larger purchase. They log onto your banking app to see what BNPL offers are available.

Personalized BNPL offers have already been generated

They find their Split Your Payments and Plan Your Purchase offers, generated based on the account their financial standing and your pre-set eligibility parameters. BNPL offers always reflect cardholders’ current account status.

BNPL offers are accepted in your banking app

Account holders can accept their BNPL offers in seconds. No credit check. No application.

Funds are deposited into checking account

equipifi BNPL automatically deposits funds into the connected checking account upon loan acceptance.

Loan is paid off over time

Based on loan terms, installment payments are withdrawn periodically from the account holder’s checking account, and their loan health is calculated into future BNPL offers.

Take a closer lookThis is Bank BNPL with the power of a fintech

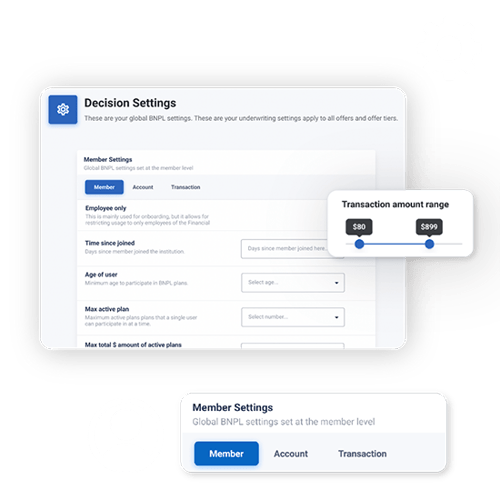

Personalized BNPL offers based on real time data

- Analyze real time account and transaction data by connecting with your banking core

- Customize your parameters for account holder eligibility, transaction qualification, land loan terms

- Provide high quality BNPL loans that align with account holder goals

Applicationless lending based on smart decisioning

- No account holder uncertainty. Present 100% prequalified BNPL offers ready to be viewed and accepted

- equipifi’s decision engine continuously generates BNPL loans within the parameters that you have set

- Offer a refreshingly simple user experience that takes less than 30 seconds to complete

Always-on platform with automated workflows

- Activate BNPL for account holders in their trusted banking app

- Automatically assess the latest debit card transactions for BNPL eligibility

- Notify account holders whenever new BNPL offers become available

core integrated

Continuous assessment through bidirectional sync

Automatically sync accepted loans back to the banking core

Re-generate prequalified BNPL offers based on updates in account and repayment status

Always provide the most up-to-date picture on account holder financial health and spending power

Why enable purchase financing on your digital banking?

Keep your debit cards top of wallet for every consumer

89% of BNPL loan repayments to 3rd-party providers are made on the debit card. These same providers are expanding to offer debit products of their own.

Give your account holders a reason to choose your debit card at checkout every time.

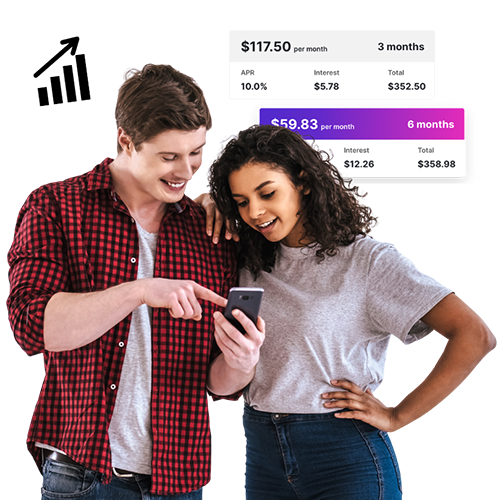

Drive growth in engagement, deposits, and accounts

Consumers increasingly prefer the payment option that helps them stretch their budget. Particularly if that financial flexibility is short term and without the pressure of traditional credit and loan products.

If loan growth and attrition are organizational priorities, leverage your inhouse BNPL to drive interest income, loan activity, and new accounts.