THE INSIGHTSPower your banking experience with data

Partner with equipifi to leverage usage insights that drive your BNPL and growth strategy

Financial flexibility needs are indicators of consumer engagement and health

What can we uncover in BNPL data?

Transactions made on your debit cards

How often do your cardholders use your debit card? Has this frequency increased since using BNPL? How often are they still using their debit cards to pay off 3rd-party BNPL loans?

BNPL offers available to your account holders

Where are account holders making purchases that require financial flexibility? Are specific categories seeing growth? Has there been a shift from in-stores to online shopping? What about by demographics?

Use and engagement in your banking app

How much uptake do you see in your account holders for their BNPL offers? What is the demographic breakdown of one time versus power users?

Re-engagement and repayment insights

Bank BNPL sees high net new uptake every month, as well as return usage. Are your account holders taking out multiple plans? How are they trending when repaying loans?

Targeted campaigns and seasonality

What does seasonality look like when it comes to the need for financial flexibility? How well are your marketing campaigns working to drive education and awareness of your BNPL solution?

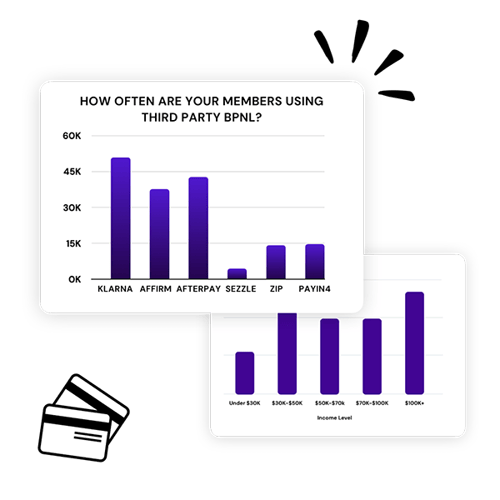

Benchmarking against the competition

How does your account holders’ use of your BNPL compare to their use of 3rd-party BNPL? How does this differ when looking at next gen consumers? How is this trending over time?

Take a closer lookConsumer preference and usage insights

Drive BNPL uptake and engagement

Track how your account holders are engaging with your BNPL solution. equipifi’s Go-To-Market team works with you to keep a pulse on user sentiment, strategize campaigns for increasing uptake, and deepen your understanding of user behavior.

Learn next gen shopping and banking preferences

BNPL is popular with next gen consumers, but is also embraced across demographics when offered from financial institutions. equipifi partners with you to monitor your BNPL performance with next gen users, and to engage them using insights derived from their purchase and payment preferences.

Gauge consumer sentiment on financial flexibility

Did you know that consumer perception of debt has changed? Increasingly, BNPL is seen more as a personal budgeting tool as well as an alternative to credit cards and traditional debt.

equipifi keeps you up to date on industry sentiments, tracking behavior shifts in aggregate Bank BNPL data.

Leveraging insights to grow wallet share

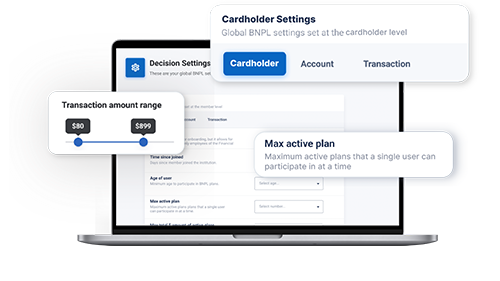

Optimize BNPL parameters for uptake and growth

Translate learnings into practical strategies for higher uptake and growth. equipifi’s Go-To-Market team not only works with you to uncover user insights but also to adapt your BNPL parameters to their shifting preferences.

Benchmark performance to monitor competition

How do you know your BNPL solution is successful? equipifi helps you benchmark your performance to 3rd-party BNPL usage and other Bank BNPL solutions to ensure that you are successfully capturing wallet share.