70% of consumers would prefer using BNPL from their trusted financial institution.

Move over Affirm, Klarna, and PayPal. It's time for Bank BNPL.

.jpg)

What is Bank BNPL?

Buy Now, Pay Later (BNPL) is a personal loan extended before, during, or after the point of sale to help consumers fit larger purchases into their budget.

Bank BNPL provides consumers the financial flexibility they want, from the credit provider they already trust, through offers that are delivered with their financial goals in mind.

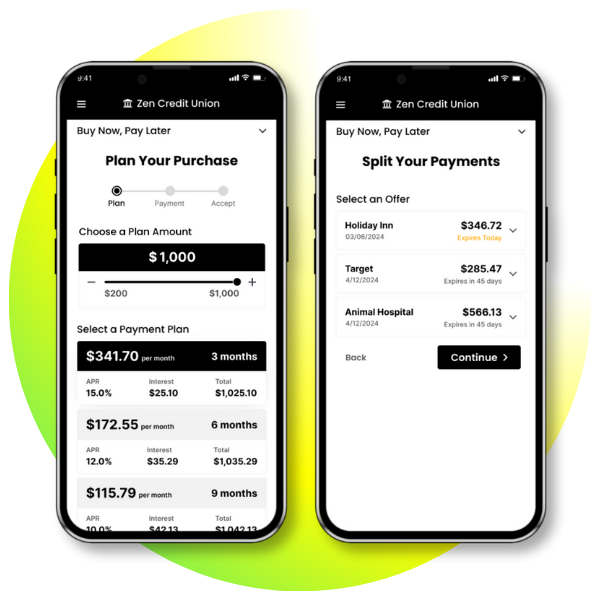

Personalized

leveraging consumer data to generate BNPL offers

Universal

accepted everywhere, merchant agnostic

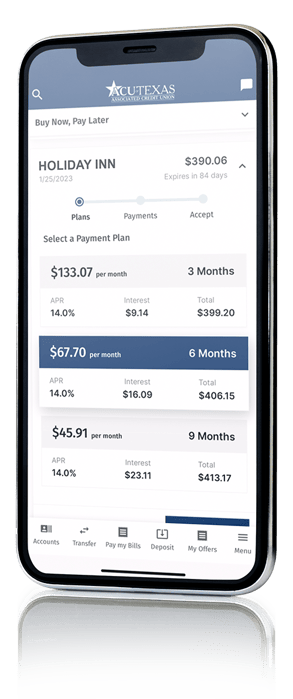

Embedded

within the existing banking experience

Trusted

and aligned with consumer protection guardrails

YOUR Financial institution, top of mind & wallet

The most effective way to grow and protect wallet share

From banking to shopping, the availability of BNPL increasingly drives consumer engagement.

To date, Apple Pay, Google Pay, Amazon, and Walmart have all released their own BNPL solutions. U.S. Bank has also introduced its own BNPL product. Many 3rd-party BNPL providers go on to issue their own debit cards.

The goal? Keeping their payment method top of wallet.

The most engaging way to drive loan volume and deposits

Consumers want purchase financing on the go.

A little extra funding at the right time can go a long way for account holders, and serving this need has caused 3rd-party BNPL providers to become one of the most profitable fintechs in Silicon Valley.

That’s all missed opportunities for financial institutions that are looking to drive loan volume and deposits.

The most seamless way to elevate your banking experience

Let’s remove all friction between consumers and the funds they need and qualify for.

Consumers want access to financial flexibility throughout their purchase-to-payment process, with over 35% of consumers preferring a single “super app” to consolidate all their purchasing, budgeting, and banking needs. The banking app, pre-integrated with checking accounts and payment methods, is the forerunner for this tool.

Same cards + same accounts + pre-qualification = seamless experience

Not your parents’ debit card anymore

BNPL is a debit card game, and split payments capabilities are a must have.

In 2022, the CFPB found that 89% of all 3rd-party BNPL repayment is being made on debit cards. Last year, Affirm’s debit card saw 75K+ new accounts opened monthly. Chase also launched Pay in 4 on its debit cards. Are your debit cards still competitive?

of consumers would prefer BNPL from their bank over fintechs

income users are the most active Bank BNPL users

of Bank BNPL users will return within 3 months

of Bank BNPL users are Millennials, with cross-demographic engagement

of consumers would prefer BNPL from their bank over fintechs

income users are the most active Bank BNPL users

of Bank BNPL users will return within 3 months

of Bank BNPL users are Millennials, with cross-demographic engagement

Flexibility for every financial moment.

Everyday Expenses

Every shopping moment is a banking moment. Free up some cash flow with BNPL.

Emergency Needs

From auto repairs to vet visits, pay for unexpected expenses over time with BNPL.

Planned Purchases

Important moments come with stretched budgets. Offer BNPL for airfare, lodging, entertainment and more.

Personal Budgeting

Give consumers a realistic and reliable picture of their spending power when they have BNPL.